It has been over a year and a half since Covid-19 hit our borders. As a procurement professional, you have had a front-row seat. You’ve stepped up despite sometimes having little to no experience in procuring specialty items like masks and gowns. Now, with new variants emerging, supply chain disruptions, and a shortage of goods and services (i.e., meats, cars, and employees), state procurement offices continue facing volatile commodity pricing. As we enter the holiday season, how can state procurement officials best navigate these uncertain markets?

Let’s start with the basics…

What are Commodities?

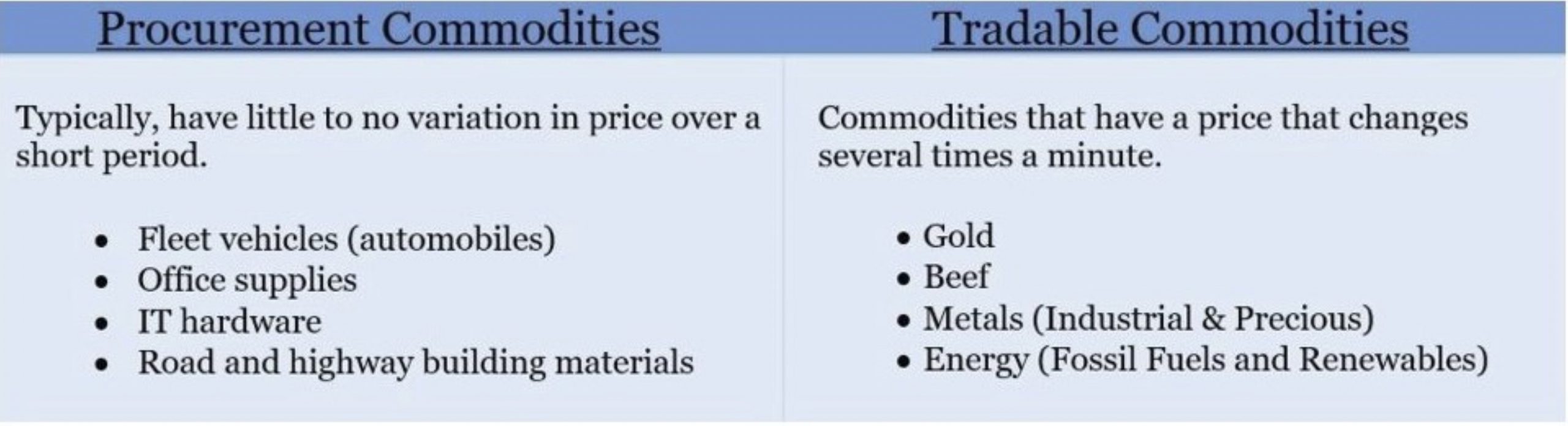

A commodity is “a basic good used in commerce that is interchangeable with other goods of the same type” and “most often used as inputs in the production of other goods or services.” Often, commodities can be further separated into two classes: procurement commodities and tradable commodities.

In other words, normally, there is very little to no price volatility in procurement commodities in the short term, while tradable commodities experience substantial volatility in the short term because of changes in supply and demand.

Price volatility is the price fluctuation of a commodity, and some commodities are more affected than others. For instance, energy prices can be volatile because most consumers cannot easily substitute their fuel uses with other fuels, such as when the price of natural gas rises most consumers cannot easily switch to oil. It is not like food where you can readily substitute products because of price. Plus, factors such as adverse weather (drought, hurricanes, and cold fronts), political events (wars), or pandemics (COVID) can have huge effects on supply and demand resulting in price volatility.

So, how can we plan for current and future price volatility in commodities?

4 Steps for Dealing with Volatility in Commodity Prices

#1 Hedge against volatile prices

A hedger is a company or individual that uses “derivatives such as futures contracts to lock in the price of specific commodities.” A futures contract is a “legal agreement to buy or sell a particular commodity at a predetermined price at a specified time in the future.” Public procurement offices can establish fixed-price contracts for a set amount of time. Also, this will serve as price protection when market prices go up because the state has the right to purchase the items at the pricing established for the length of the contract term. Check your office’s policy on futures contracts and hedging practices.

#2 Establish a commodity management procurement strategy

To create a commodity management strategy for your procurement office, begin by taking the following steps:

- Perform a spend analysis: Analyze all commodities being purchased and forecast items needed in the near future.

- Use an industry analysis: Identify major supply vendors and consider all competing demands like customer power and supplier power.

- Identify and document market trends: Identity, track, and report on the market trends of the top commodities in your state.

- Implement the strategies: Make sure you comply with all statutes and laws and practice good change management.

#3 Strategic Sourcing

Procurement offices should build strong relationships with suppliers when creating contracts. By establishing fixed prices for crucial items ahead, offices can be better prepared for an emergency. Additionally, offices can assess current suppliers for quality and price and select multiple suppliers for backup and secondary sourcing. See NASPO’s Procurement Toolbox Issue 9: Strategic Sourcing.

#4 Market Research

Before starting a bid for a commodity, you should do some of the following:

- Do price benchmarking by researching competitive pricing. See NASPO’s Intro to Market Research course on Procurement U.

- Research suppliers and products (Procurement IQ is a comprehensive market research tool available to NASPO members through the NASPO Network.)

- Study supply chains and stay up-to-date on current events by putting alerts on news websites such as Supply Chain Brain and Supply Chain Dive.

- Anticipate demand for seasonal products, such as salt for roads during the winter and natural gas during hurricane season.