The Good News

There is federal funding for COVID-19 relief (CARES Act) for states. This funding can be used by states in many ways to provide relief.

The Bad News

The broad language of the CARES Act leaves little instruction for steps states should take to maintain compliance. Making this more complicated is the fact that procurement offices may have little or no control over CARES Act spending and the associated documentation.

- Accurate representation: all data should be checked often and kept up to date.

- Record everything: keep all receipts and records in a centralized location. Consider centralizing all expenditures and accounts related to COVID-19 expenses.

- Use internal reviews early and often: As the rules of different federal funding acts change, keep up to date to monitor expenses and accounts.

- Follow audit trends: keeping an eye on audits across industries can inform your compliance process as clarification and changes emerge.

Oversight

The size of COVID-19 relief funding is unprecedented. The closest Congress came to a spending bill this size was in 2008 when $152 billion was spent by the federal government through the Economic Stimulus Act. In response, the Troubled Asset Relief Program (TARP) was started by Congress. TARP was charged with the compliance and oversight of fund use under the direction of the Special Inspector General (SIG).

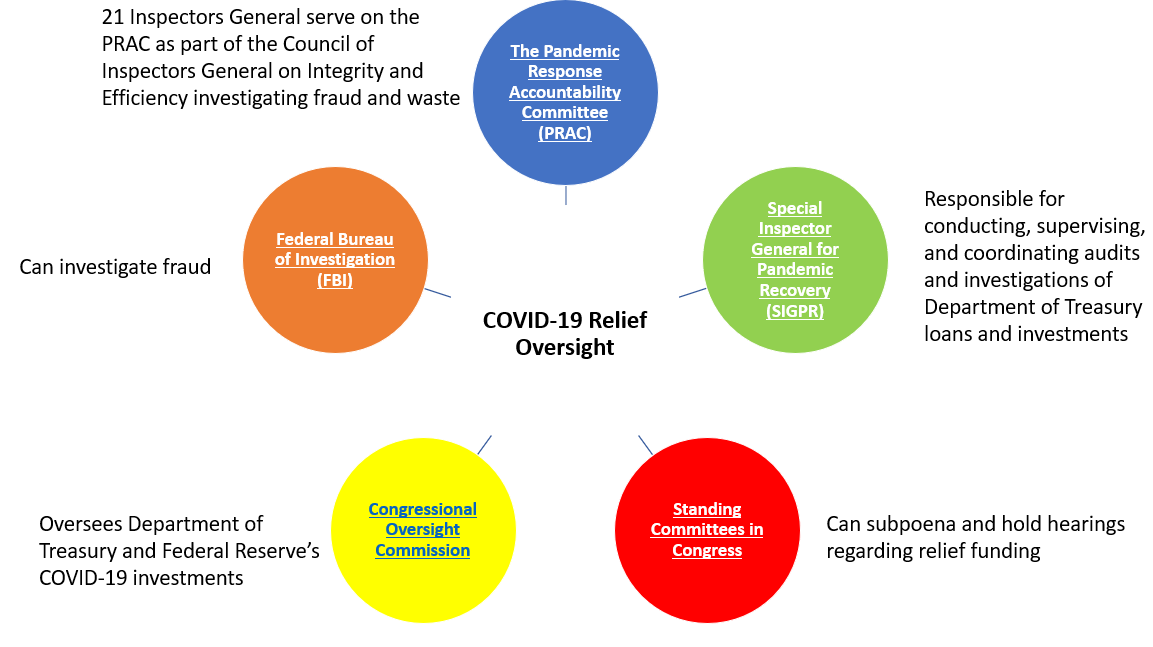

In response to the COVID-19 pandemic and subsequent economic crisis, the federal government has spent $3.5 trillion through the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) and other relief programs. Unsurprisingly, there are not one but many bodies of oversight for the CARES Act and other COVID-19 related federal assistance initiatives including:

All this oversight means there will be more audits of expenditures related to COVID-19 federal aid.

CARES Act funding covers costs with 3 requirements:

- Necessary expenditures incurred due to the public health emergency with respect to COVID-19

- These may include expenditures from State, territorial, local, or Tribal government to respond directly to the emergency like addressing medical or public health needs or expenditures incurred to respond to second-order effects of the emergency including economic support to those suffering from employment or business interruptions due to COVID-19-related business closures.

- Expenditures not accounted for in the budget most recently approved as of March 27, 2020 (the date of enactment of the CARES Act) for the State or government.

- The “most recently approved” budget refers to the enacted budget for the relevant fiscal period for a State, territorial, local or Tribal government, without taking into account subsequent supplemental appropriations enacted or other budgetary adjustments made by that government in response to the COVID-19 public health emergency.

- Expenditures incurred during the period that begins on March 1, 2020 and ends on December 30, 2020.

- A cost is “incurred” when a unit of government has expended funds to cover the cost.

In response to COVID-19 related needs, US General Services Administration (GSA) has several resources for states including buying guides, market research, and purchasing programs.